Your Essential document Checklist for IRS Form 720

Filling out IRS Form 720 is often viewed as a daunting task. It indeed is. If you are not really aware of all the intricate details necessary to ensure your filing is spot on, you may find yourself on bad terms with the IRS. It is essential to understand each of the sections and what they comprise so that you will be able to assess your Quarterly Federal Excise Tax Return seamlessly. In this article, we have broken it down into straightforward steps to help you navigate the process more easily. Here's a user-friendly guide to help you understand each step.

Before you continue reading on, it’s better you grab your Form 720 to follow along and mark sections relevant to you.

Gather Your Details.

Before you start, make sure you have all the necessary documents at your fingertips. You'll also need information about your business's inventory, total sales, units sold, and other relevant details. Having these documents with you beforehand will make the filing process smoother.

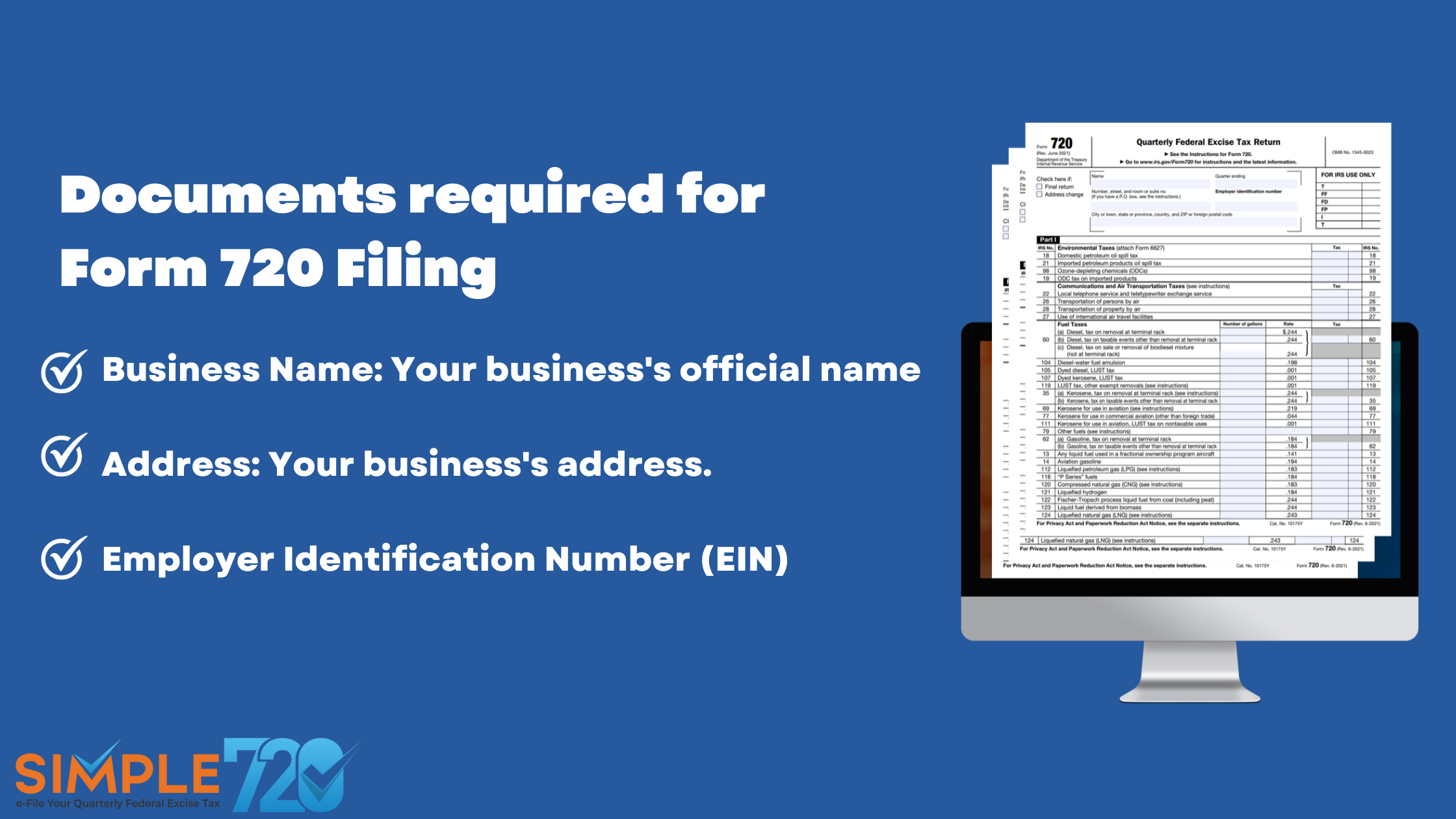

Documents required for filing form 720

This step involves entering some basic information about your business:

- Business Name: Your business's official name.

- Address: Your business's address.

- Employer Identification Number (EIN): A unique number for your business, issued by the IRS.

Completing Part I

Part I of Form 720 deals with specific excise taxes. You only need to fill out this part if your business owes any of these taxes. The form provides a clear list of products and services that fall into these categories. If you're unsure, you can refer to the IRS Form 720 instructions for guidance.

In the "Rate" column, calculate what your business owes based on your total sales or units sold.

Add up the amounts in the "Tax" column and combine them at the bottom of Part I.

Completing Schedule A

Schedule A is essential if your business owes taxes as outlined in Part I. Here, you'll need to record your net tax liability for each semi-monthly period and then add these figures to determine your total liability. Usually, you'll only need to complete section 1 of Schedule A. If you're unsure, consult the IRS instructions for specific requirements.

Filling Out Part II

Part II of Form 720 also deals with excise taxes on different products and services. Even the Part II process is very much similar to Part I.

Completing Schedule T

If your business is involved in the production or sale of diesel, kerosene, gasoline, or aviation gasoline, you'll use Schedule T. This section is for reporting the total volume of fuel delivered or received in a two-party exchange within a terminal.

Filling Out Schedule C

Schedule C allows you to reduce your tax liability for both Part I and Part II of Form 720 by claiming that your business produces or sells fuel used for specific purposes, like farming, foreign trade, or military use. To do this:

- Complete Schedule C with the appropriate use-case number.

- Add the associated tax rate, number of gallons, and the dollar amount of your claim.

Completing Part III

In Part III, you'll consolidate the information from the previous sections:

- Add the totals from Part I and Part II to box 3.

- Include your total claims from Schedule C in box 4.

- Record any excise tax deposits for the quarter in box 5.

- If you've overpaid excise taxes in previous quarters, add the total excess payments to boxes 6 and 7.

- Add boxes 5 and 6 to get the total in box 8.

- Add boxes 4 and 8 to obtain the total in box 9.

- If the total tax in box 3 exceeds the amount in box 9, put the difference in box 10 (this is your balance due).

- If the amount in box 9 exceeds that in box 3, use box 11 to indicate whether you want a refund or apply it to your next return.

- Finally, sign and date the form.

Filing Form 720 and Settling Any Balance Due

After reviewing Form 720 for accuracy, you're ready to submit it to the IRS. You have two options:

- Mail it to the IRS using the provided address mentioned in IRS 720 Instructions.. You can find the address here.

- Partner with the IRS Authorized provider like Simple 720 to complete your filings online.

No matter how you choose to file, if your business has a balance due in box 10 of Part III, be sure to pay it at the time of filing. You can do this by check, money order, or direct debit.