A Complete Guide on Form 720 Filing for LLCs

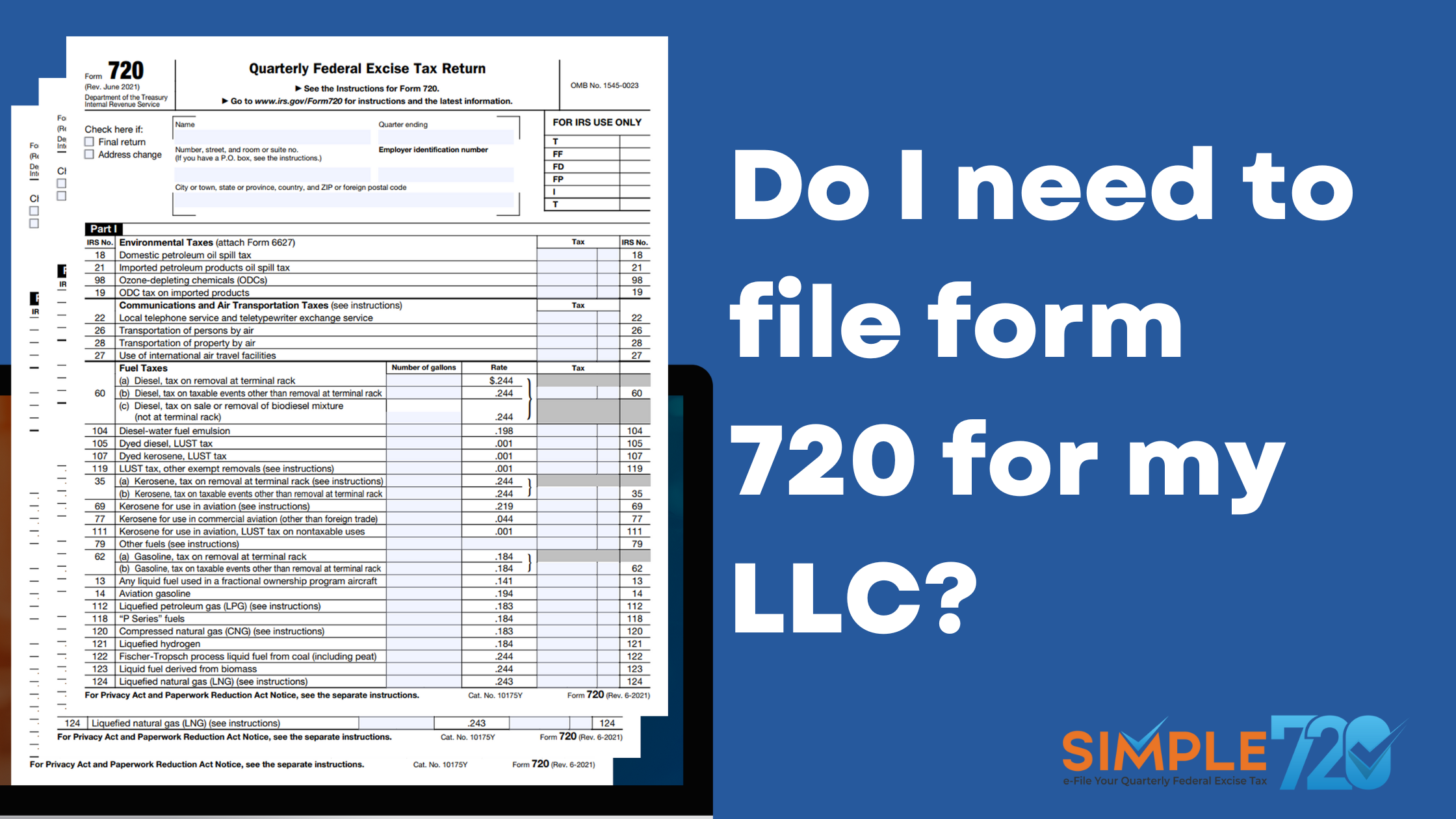

If you want to know whether you need to file Form 720 for your LLC, you should consider the nature of your LLC's business activities. Form 720 is generally used to report and pay excise taxes. These include taxes related to the sale of certain goods, services, or activities. Let us explore some key points that you may need to consider.

- Type of Business: If your LLC is engaged in activities that are subject to federal excise taxes, such as the sale of tobacco, alcohol, or firearms, or if it operates in certain regulated industries, you may need to file Form 720.

- Annual Sales: The threshold for filing Form 720 can vary depending on the type of excise tax. It's important to review the specific excise tax requirements related to your business activities.

- Location: Some state and local governments also impose excise taxes, so it's crucial to check whether your LLC is subject to any additional tax obligations at the state or local level.

- Consult a Tax Professional: Given the complexity of tax regulations and the unique characteristics of your LLC, it's advisable to consult with a tax professional or accountant who can provide guidance tailored to your situation.

- IRS Guidance: The Internal Revenue Service (IRS) provides detailed information and instructions for Form 720 on its official website. You can refer to the IRS website or contact them directly for specific guidance.

Understanding Form 720 for Your LLC

If you own a business that deals in goods and services subject to excise tax, it's crucial to understand and properly file IRS Form 720. This quarterly tax return is a legal requirement, and compliance is essential to avoid penalties and ensure your business operates smoothly. In this comprehensive guide, we'll walk you through the ins and outs of Form 720, providing you with all the information you need to navigate this important aspect of your LLC's financial responsibilities.

Understanding Single-Member Limited Liability Companies

In the world of business, structures, and classifications matter a lot. The way your business entity is recognized usually has significant implications, especially when it comes to taxes. Single-member limited Liability Companies (LLCs) are a versatile entity with unique tax considerations. In this guide, we will understand the intricacies of single-member LLCs, so that you can navigate the classification and tax obligations effectively.

The Nature of Single-Member LLCs

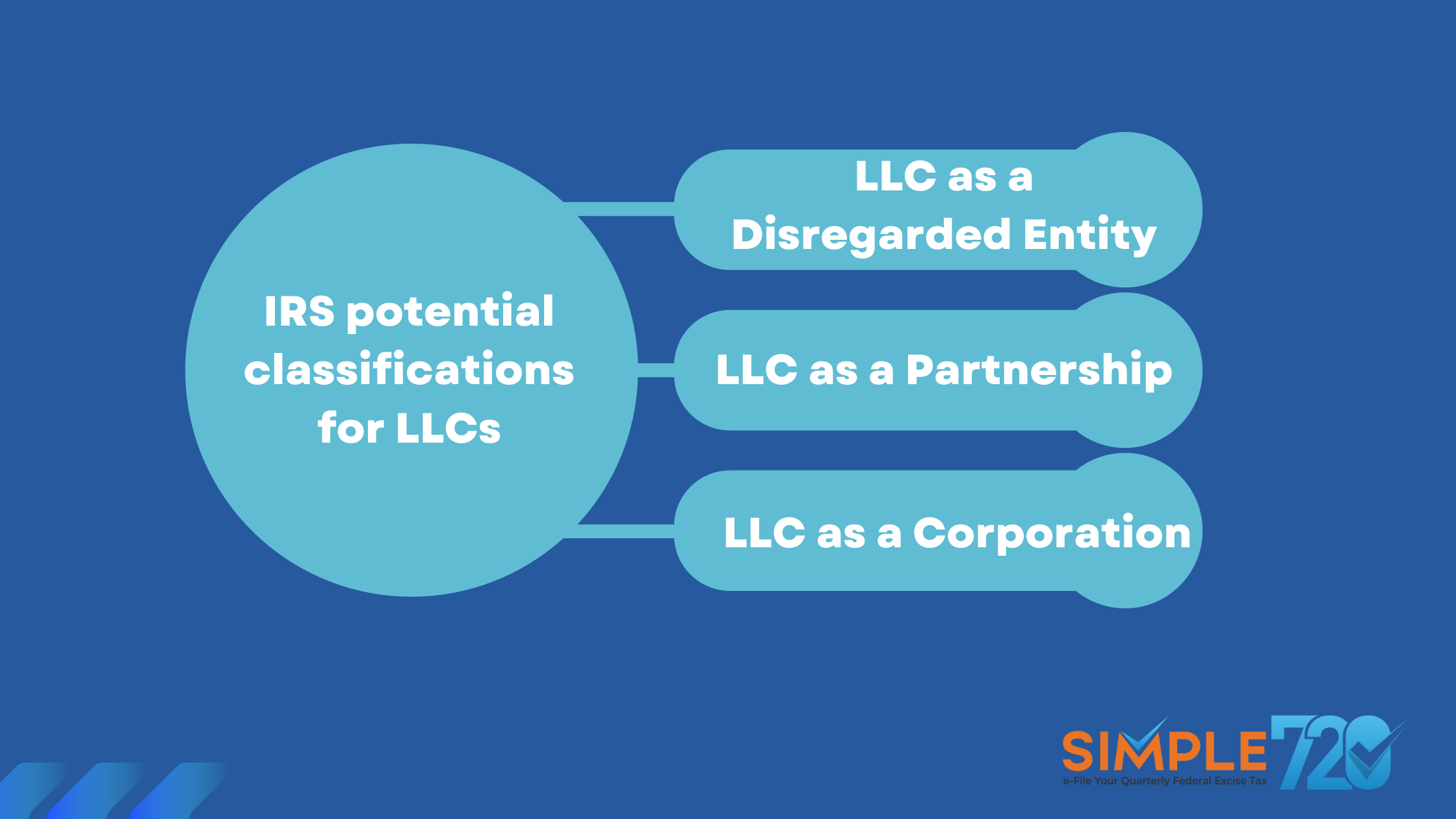

A Limited Liability Company (LLC) is a legal entity formed under state statutes, distinct from its owner. As the name suggests, a single-member LLC has only one owner. The IRS offers three potential classifications foLLCs: corporation, partnership, or disregarded entity. The specific classification depends on the LLC's elections and the number of members.

LLC Tax Filing Requirements Based on IRS Classification

The IRS classifies LLCs into different categories, and the tax forms you need to file depend on your LLC's classification. Let's explore each classification in detail:

1. LLC as a Disregarded Entity

If your LLC has only one member, the IRS typically classifies it as a separate entity from its owner. In this case, the LLC owner should report tax declarations on the following IRS forms:

- Form 1040, Schedule C: Used to report business profit or loss for sole proprietorships.

- Form 1040, Schedule C-EZ: For reporting net business profit for sole proprietorships.

- Form 1040, Schedule E: Used to report supplemental income and loss.

- Form 1040, Schedule F: For reporting farming profit or loss.

It's important to note that the sole member of the LLC should not file a separate income tax return. However, the member is considered a corporation for the purposes of employment tax, as well as for collecting income and excise taxes. Additional information about this classification can be found in the following IRS forms:

Taxpayer Identification Number

For federal income tax reporting, a single-member LLC operating as a disregarded entity uses the owner's Social Security Number (SSN) or Employer Identification Number (EIN) for information returns and reporting related to income tax. However, for certain employment and excise tax requirements, the LLC's EIN is used.

If your single-member LLC has employees or is required to file specific excise tax forms, it will need an EIN. The application process involves filing Form SS-4, Application for Employer Identification Number.

Employment and Excise Tax Obligations

In 2007, regulations were established to treat disregarded LLCs as taxpayers for certain excise taxes accruing from January 1, 2008, and employment taxes accruing from January 1, 2009.

For wages paid after January 1, 2009, a single-member disregarded LLC must use its name and EIN for reporting and payment of employment taxes. The same applies to excise tax activities, which must be reported using Form 637 and paid on Forms 720, 730, 2290, and 11-C. Refunds, credits, and payments are claimed on Form 8849.

- Form 637: Provides instructions for registration for excise tax activities.

- Form 720: Used for returns of quarterly federal excise tax.

- Form 730: For monthly tax returns related to wagers.

- Form 2290: Used for tax returns for heavy highway vehicles.

- Form 11-C: Pertains to wagering occupational tax and registration return.

- Form 8849: Provides guidance on excise tax refund claims.

2. LLC as a Partnership

For LLCs with two or more members classified as a partnership, the primary tax form to file is Form 1065 (U.S. Return of Partnership Income). It's important to note that only the LLC's member manager can sign the partnership tax return. If there's no designated or elected member manager, each LLC owner is treated as a member manager.

3. LLC as a Corporation

Regardless of whether an LLC has a single member or multiple members, it has the option to be classified as a corporation. You’ll need the following things:

- Form 8832: This form is used to elect classification as a C corporation. A copy of this form must be attached to the federal income tax return of each LLC owner.

- Form 2553: To file to be an S corporation An LLC classified as a corporation must also file a corporation income tax return, which can be done using Form 1120 or Form 1120S.

Joint LLC ownership for spouses in community property states

If an LLC is solely owned by a husband and wife in a community property state, it's classified as a disregarded entity for federal tax purposes. This classification is accepted by the IRS. Conversely, if it's treated as a partnership, the IRS will acknowledge it as such. Any change in classification is regarded as a conversion for federal tax purposes.

Single-member LLCs present distinct tax considerations, particularly in terms of classification and tax obligations. Understanding these intricacies is vital for responsible business management. Being aware of the nature of your organizational structure is a highly critical aspect of managing business taxation.

Changing LLC Classification

It's worth noting that an LLC has the option to change its classification. However, there are certain conditions and timeframes to consider. An LLC can apply for a change in classification 60 months after a previous classification change becomes effective. It's crucial to be aware that such classification changes come with tax consequences, and detailed information can be found in Publications 541 and 542 provided by the IRS.

How to Fill Out Form 720

Filling out Form 720 might seem like a daunting task, but it's manageable when you break it down into steps. Here's a step-by-step guide on how to complete your Form 720:

- Enter Your Business's Information: Start with the basics. Provide your business information accurately.

- Fill in Part One: This section requires you to specify the type of return and the quarter you're filing for.

- Fill Out Schedule A: Schedule A covers the various liability categories, so make sure to fill it out correctly.

- Fill Out Part Two: This part of the form focuses on your tax liability. Be precise in your calculations.

- Fill Out Schedule T and Schedule C: These schedules deal with environmental taxes and the claims section, respectively.

- Fill Out Part Three: In this section, you'll summarize your tax liability, ensuring that the numbers align with the information provided earlier.

- File Form 720: Double-check your entries, and once you're confident, submit your Form 720.

Check out the detailed guide on documents required for form 720 filing, and steps involved while filing.

Can I File Form 720 Online?

Yes, you can! The IRS now accepts electronically filed Forms 720, making the process more accessible and efficient. This online option is available 24 hours a day, offering convenience and speed for business owners.

Go with IRS Authorized Online Service Provider like Simple 720 for your filing

Failing to File Form 720: What Are the Consequences?

It's crucial to meet your filing obligations. Failure to file Form 720 or pay the taxes owed can result in penalties. To avoid these penalties, it's essential to adhere to the IRS guidelines and deadlines.

The Wrap

Remember, if you have any doubts or require specific guidance regarding your single-member LLC, it's advisable to consult with an IRS-authorized tax provider or a legal advisor. Compliance with IRS regulations ensures that your business is reliable and within the law, thereby ensuring a trouble-free journey for your business entity.

Understanding the intricate landscape of LLC tax filing requirements is essential for ensuring compliance with IRS rules and regulations. The IRS has laid out clear guidelines for each classification, leaving little room for ambiguity. With this comprehensive guide, there's no need to wonder, "What tax forms do I need to file for an LLC?" You now have the knowledge and resources to navigate the tax requirements for your LLC effectively.