Form 720 Mastery: Tanning Tax Compliance

The world of taxes can be complex, and for tanning businesses, navigating the intricacies of excise taxes is crucial. In this blog, we'll delve into the compliance essentials specifically tailored for tanning companies, focusing on the Indoor Tanning Services Tax reported through IRS Form 720.

What is Indoor Tanning Services Tax?

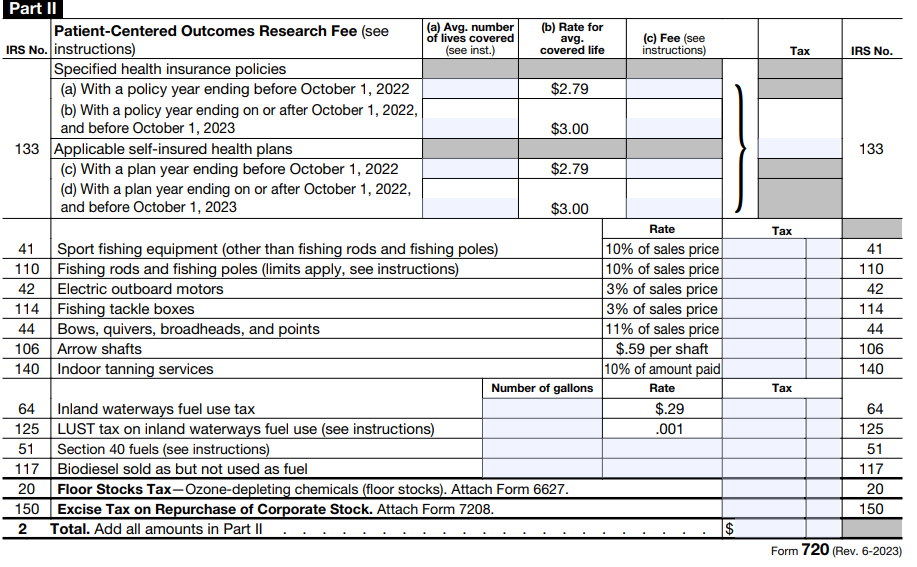

Indoor tanning services are subject to a specific excise tax known as the Indoor Tanning Services Tax. This tax was introduced to discourage the use of tanning services due to the associated health risks. The Tanning Tax rate is 10% of the amount paid for the indoor tanning service as instructed by the IRS. It's essential to stay informed about any changes in rates or regulations that may affect your business.

Key Compliance Requirements

Compliance with tax regulations is a non-negotiable aspect of running a tanning business. Failure to comply can lead to penalties and legal consequences. Key compliance requirements include timely filing of IRS Form 720 and accurate reporting of the indoor tanning services provided. Businesses must keep meticulous records of transactions and revenues related to indoor tanning to ensure accurate reporting.

Step1: Gather Necessary Information

Collect details about your indoor tanning services, including the total amount received for these services during the quarter.

Step 2: Download Form 720

Download here the most recent version of Form 720 to file if you are planning to file through paper. But IRS suggests to file your tax form 720 online. Now, provide your business information, and other tax-related information.

Step 3: Ignore Part I and move to Part II

Provide relevant details under indoor tanning services (IRS No: 140). You can provide the actual indoor tanning service cost alone if you would offered a bundled service.

Step 4: Complete Part III – Payment Voucher V

Complete Part III of the form and finally followed by payment Voucher. Provide your business information, complete address, amount etc., in payment voucher section.

Step 5: File and Pay

Submit the completed Form 720 to the IRS by the specified deadline, typically the last day of the month following the end of the quarter. If you owe taxes, ensure the payment accompanies the form.

Common Mistakes to Avoid:

Avoiding common mistakes in Form 720 filing is crucial for tanning businesses. Some pitfalls to be mindful of include:

- Incorrect Calculation of Tax Liability: Ensure accurate calculations based on the total amount received for indoor tanning services.

- Late Filing: Submit Form 720 by the deadline to avoid penalties for late filing.

- Incomplete Records: Maintain comprehensive records to support the information reported on Form 720.

Check out the other mistakes you must avoid while filing IRS Form 720

Best Practices for Record-Keeping:

Effective record-keeping is the backbone of excise tax compliance. Implement the following best practices:

- Organize Documents: Keep all relevant documents, such as sales receipts and invoices, organized and easily accessible.

- Digital Record-Keeping: Consider digital solutions for record-keeping, making it easier to search and retrieve information.

- Regular Audits: Conduct regular internal audits to ensure your records align with your reported figures on Form 720.

Maintaining accurate records not only facilitates compliance but also simplifies the tax filing process.

Closing Thoughts:

In conclusion, excise tax compliance is a critical aspect of running a tanning business. Understanding the Indoor Tanning Services Tax, adhering to key compliance requirements, and mastering the art of Form 720 filing are essential for the financial health and legal standing of your business.

Filing your Tan Tax online makes your filing process seamless. Partner with the IRS-Authorized Simple 720 now!

Why still waiting?

File Tanning Tax with Simple 720