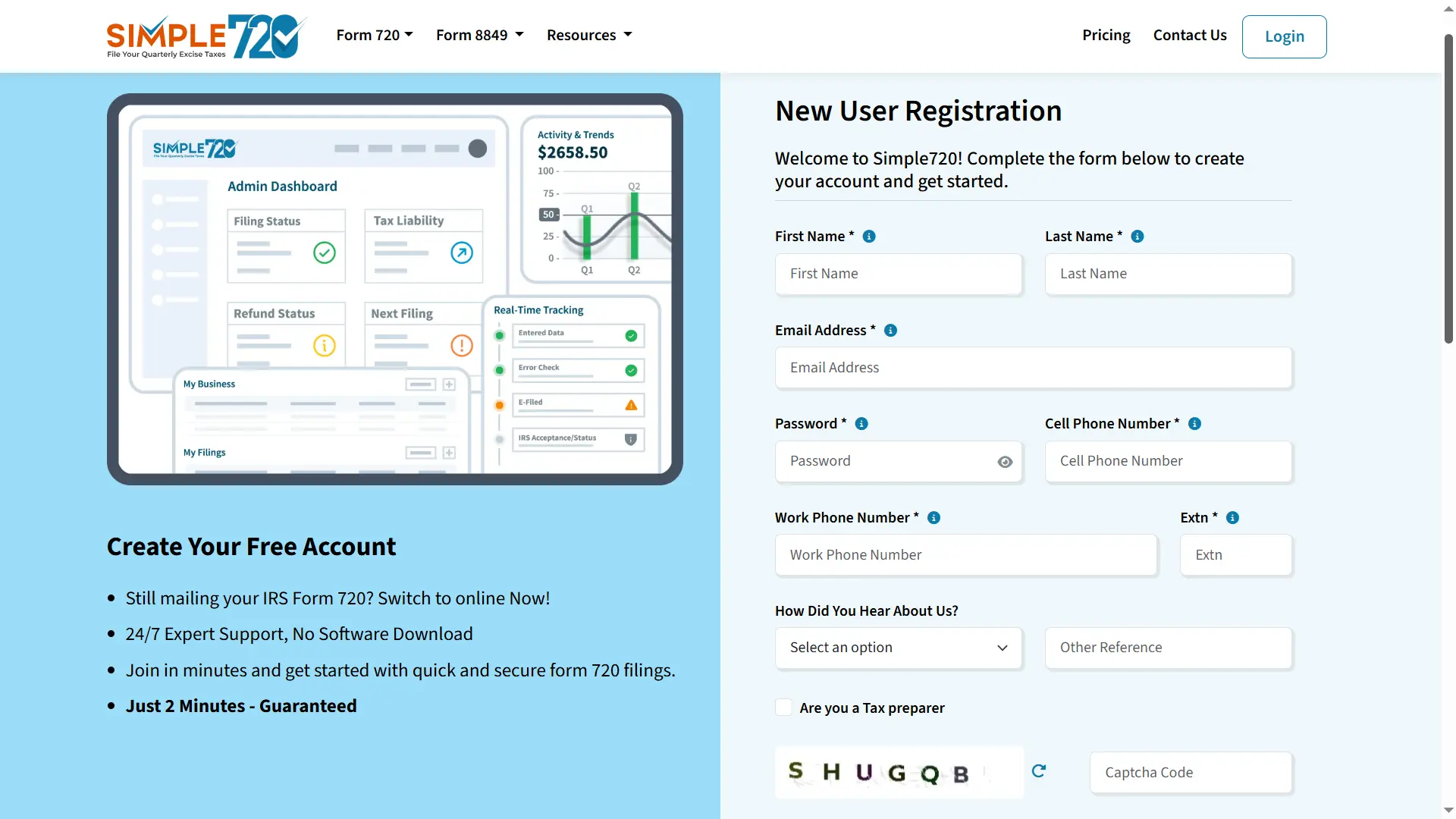

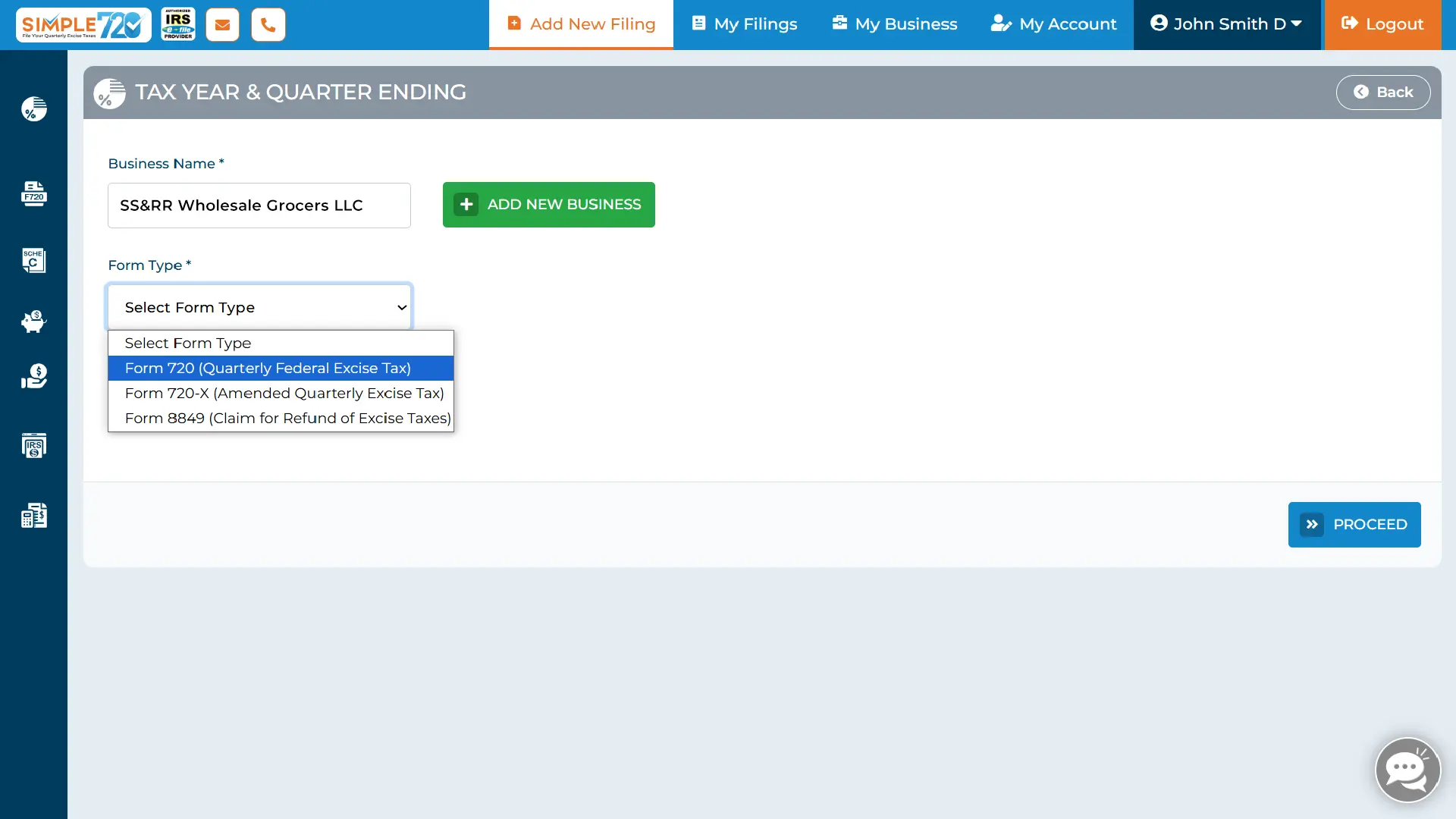

Simple720 is an IRS-approved system for filing Form 720 and Form 8849 excise tax returns online. The IRS has stated that electronic filing is the preferred method, as paper submissions are facing major delays and, in some cases, aren't being processed at all.

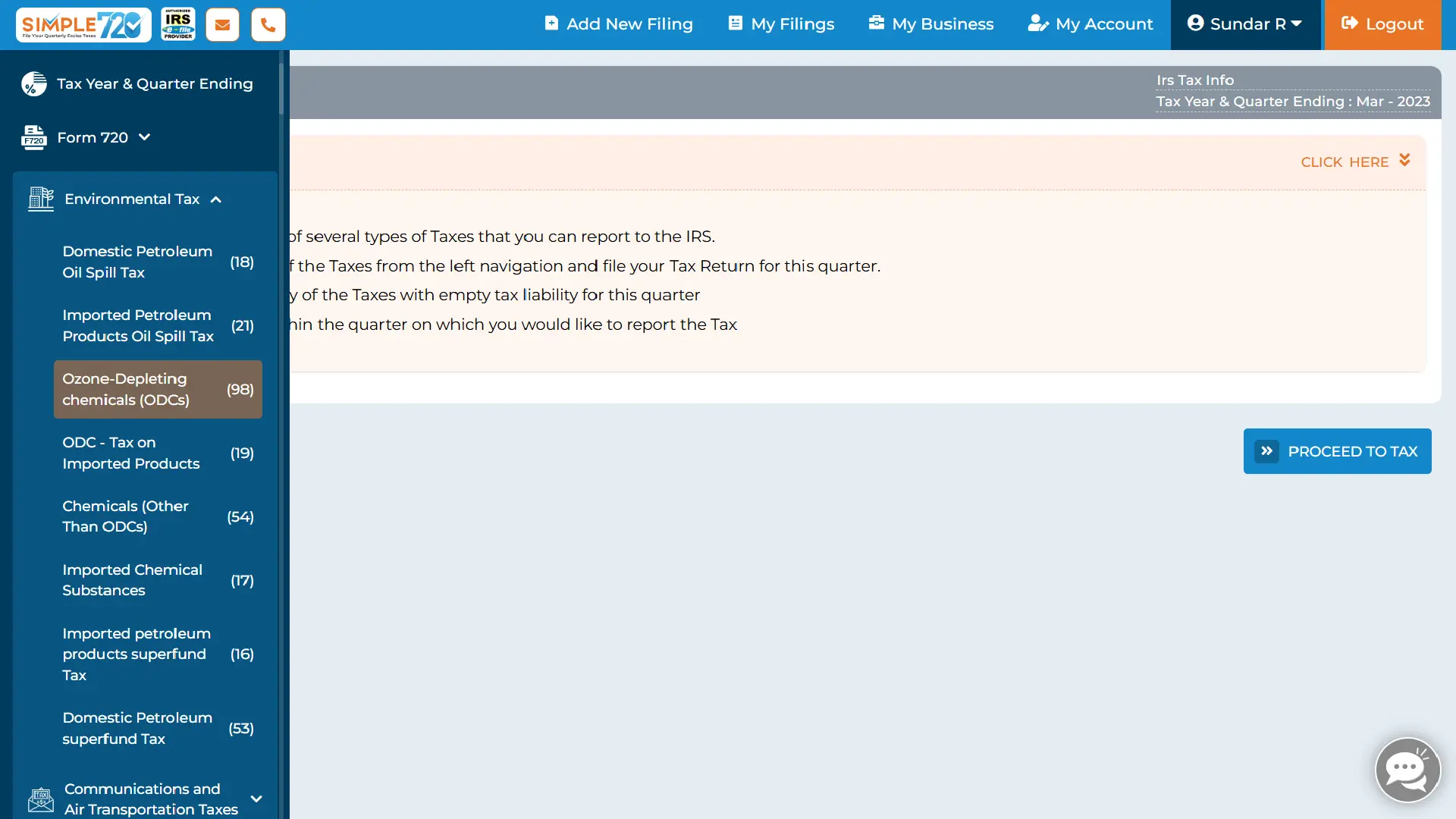

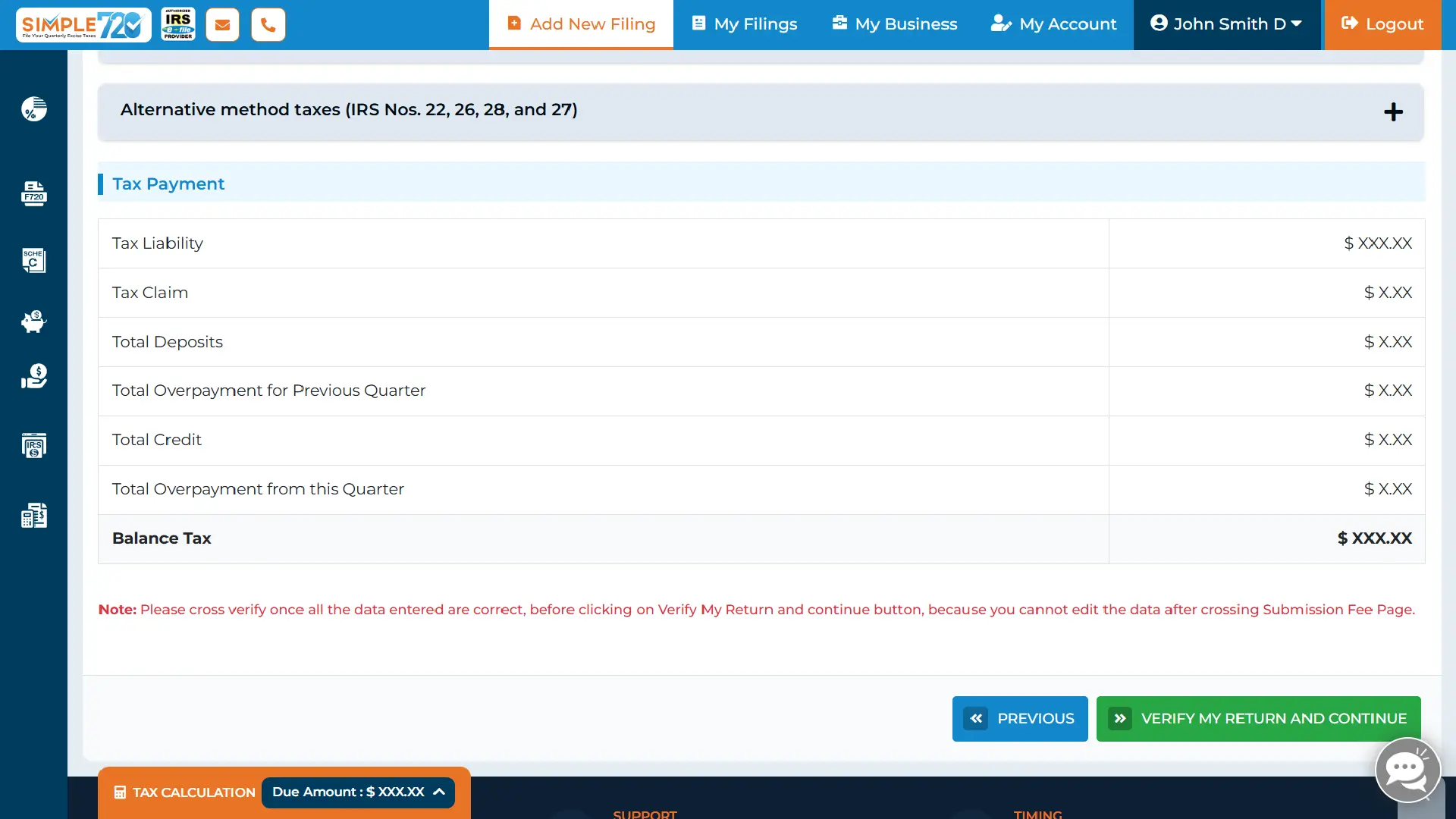

The platform helps you prepare your taxes electronically, automatically calculates the tax for all applicable categories, and securely sends your forms to the IRS through an approved system. You’ll get official IRS acknowledgment within minutes.

Simple720 is officially SOC 2 certified, ensuring that taxpayers' information is stored securely. It is fully compliant with the IRS, providing accurate, timely, and exclusively electronic excise tax reporting.