Claim Your Form 720 Schedule C Credits for Kerosene Used in Aviation with Simple720!

- Effortless and streamlined process

- Quick submission with assured accuracy

- Available 24/7 with secure online filing

What is Kerosene Used in Aviation

under Schedule C Claim of Form 720?

Kerosene used in aviation refers to kerosene fuel used for qualifying aviation purposes where the federal excise tax paid is eligible to be claimed under IRS Form 720 Schedule C. These claims apply to specific commercial and noncommercial aviation uses, as defined in the Schedule C instructions.

- Kerosene used in commercial aviation (other than foreign trade) taxed at $0.244 (Line 5a) is eligible for a claim at $0.200 per gallon.

- Kerosene used in commercial aviation (other than foreign trade) taxed at $0.219 (Line 5b) is eligible for a claim at $0.175 per gallon.

- Nontaxable use (other than use by state or local government) taxed at $0.244 (Line 5c) is eligible for a claim at $0.243 per gallon.

- Nontaxable use (other than use by state or local government) taxed at $0.219 (Line 5d) is eligible for a claim at $0.218 per gallon.

- LUST tax on aviation fuels used in foreign trade (Line 5e) is eligible for a claim at $0.001 per gallon.

When You Are Eligible to Claim Kerosene Used in Aviation

You are eligible to claim the nontaxable use of kerosene used in aviation if it

was used during the claim period for one of the following allowable purposes:

The ultimate purchaser of kerosene used in commercial aviation (other than foreign trade) is eligible to make this claim. The kerosene must have been used during the claim period for commercial aviation purposes. If the claimant buys kerosene partly for use in commercial aviation and partly for use in noncommercial aviation, refer to Notice 2005-80, section 3(e)(3).

The kerosene must have been used during the claim period for Type of Use 9 (foreign trade). This claim is made in addition to the claim made on lines 5c and 5d for Type of Use 9.

The ultimate purchaser of kerosene used in noncommercial aviation (except for nonexempt, noncommercial aviation and exclusive use by a state, a political subdivision of a state, or the District of Columbia) is eligible to make this claim. The kerosene must have been used during the claim period for one of the following types of use:

- Type of Use 1: On a farm for farming purposes

- Type of Use 9: In foreign trade

- Type of Use 10: Certain helicopter and fixed-wing aircraft uses

- Type of Use 11: Exclusive use by a qualified blood collector organization

- Type of Use 13: Exclusive use by a nonprofit educational organization

- Type of Use 15: In an aircraft or a vehicle owned by an aircraft museum

- Type of Use 16: In military aircraft

Note - In all cases, the claimant must certify that the right to make the claim has not been waived.

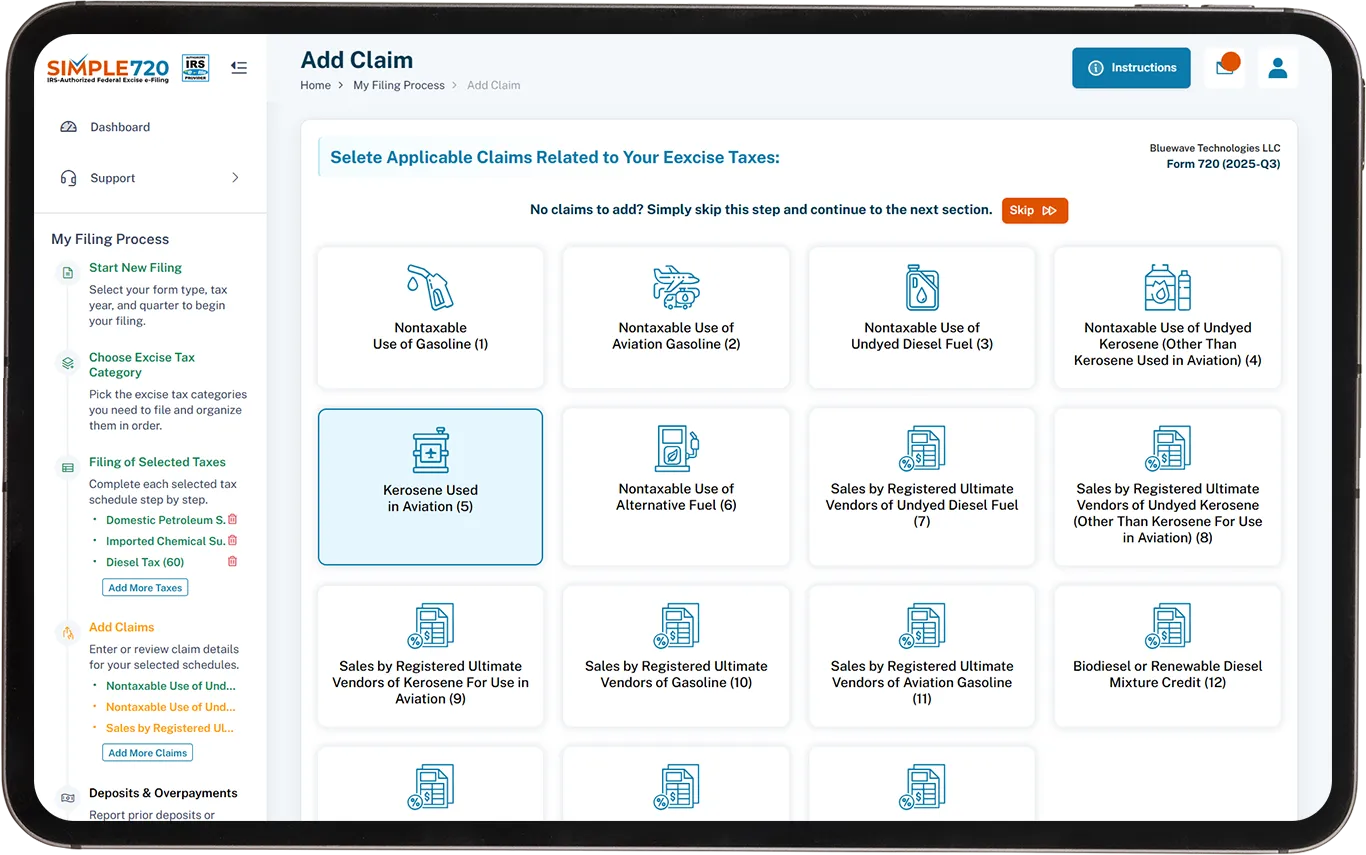

How to Claim Your Kerosene Used in Aviation

Why File Electronically for Kerosene Used

in Aviation with Simple720?

Effortless Filing Process

Simple720 made filing my claim for nontaxable use of kerosene in aviation so simple. I didn’t have to deal with complicated paperwork, and the platform guided me through the process with ease.

Fast and Secure Filing

Filing my aviation kerosene claim was faster than I expected. The platform is secure, and I got my confirmation in no time. Simple720 made the entire process stress-free!

Exceptional Customer Support

I had a few questions about the filing, and the customer support team at Simple720 was incredibly helpful. They guided me through the process, ensuring everything was correct. Great experience!

Want to learn more?

Request a free demo today! Our experts are ready to assist you.

Book a Demo