Schedule 8: Registered Credit Card Issuers

What Is Form 8849 Schedule 8?

- Form 8849 Schedule 8 is used by registered credit card issuers to claim refunds of federal excise tax paid on certain taxable fuel sales made to eligible state or local government entities and qualified educational organizations.

- Schedule 8 is filed with Form 8849 and requires reporting the applicable fuel category, gallons, credit rate, and refund amount as shown in the Schedule 8 line items.

Primary Purpose of Form 8849 Schedule 8

- The primary purpose of Form 8849 Schedule 8 is to allow registered credit card issuers to claim refunds of federal excise tax paid on eligible taxable fuel sales made to qualified state or local government entities and educational organizations. This schedule ensures that excise tax is refunded when fuel transactions meet IRS eligibility requirements and are properly reported.

Who Can File Form 8849 Schedule 8?

Form 8849 Schedule 8 may be filed only by registered credit card issuers that paid federal excise tax on

eligible taxable fuel sales made to qualified state or local government entities and educational organizations.

Fuel Tax Refund Claims

Issuers

Fuel Sales

Form 8849 Schedule 8 Filing Deadline

- Form 8849 allows only one Schedule 8 filing per calendar quarter. Claims must be submitted after the quarter in which the aviation fuel excise tax qualifies for a refund.

- Schedule 8 claims follow the standard Form 8849 quarterly filing cycle. Refund requests related to aviation fuel activity from earlier quarters must be filed within the IRS-prescribed quarterly window.

- Claimants must comply with aviation fuel eligibility rules, filing instructions, and record-keeping requirements specific to Schedule 8 to avoid delays or rejection.

Table to Refer for Deadlines of Schedule 8

| Earliest Quarter Included in Claim |

Filing Deadline (Last Day of Next Quarter) |

|---|---|

| Q1 (Jan-Mar) | June 30 |

| Q2 (Apr-Jun) | September 30 |

| Q3 (Jul-Sep) | December 31 |

| Q4 (Oct-Dec) | March 31 (Following Year) |

Specific Instructions for Form 8849 Schedule 8

Manual filing vs Online filing steps with

Simple 720 for your Form 8849 Schedule 8

Form 8849 Schedule 8

- Step 1 - Download the latest versions of Form 8849 and Form 8849 Schedule 8 from the official IRS website to ensure you are using the most current documents.

- Step 2 - Complete the basic details required in Form 8849, including the business name, address, phone number, ZIP code, Employer Identification Number (EIN), Social Security Number (SSN), and the month the claimant’s income tax year ends.

- Step 3 - Mark the appropriate checkbox for "Other Claims" on the Schedule 8 section of Form 8849 to indicate the relevant credit you are claiming.

- Step 4 - Below are the steps to fill Form 8849 Schedule 8. Enter your business name and EIN. These should match exactly with the details provided on Form 8849 to ensure consistency and avoid discrepancies.

- Step 5 - Provide the period of claim (from and to) and the total refund amount. Enter the claimant’s registration number. Carefully review the instructions page to accurately determine and input the correct refund amount.

- Step 6 - Enter the relevant category under a specific line item. Col a has the tax rate mentioned already

- Step 7 - Enter the quantity in gallons in col b. Multiply col a and col b value and enter in col c.

- Step 8 - Sign and date Form 8849 to validate the filing, confirming the accuracy of all information provided.

- Step 9 - Mail both completed forms (Form 8849 and Schedule 8) to the appropriate IRS mailing address, as specified in the Where To File Section of Form 8849 instructions , to finalize your submission.

Form 8849 Schedule 8

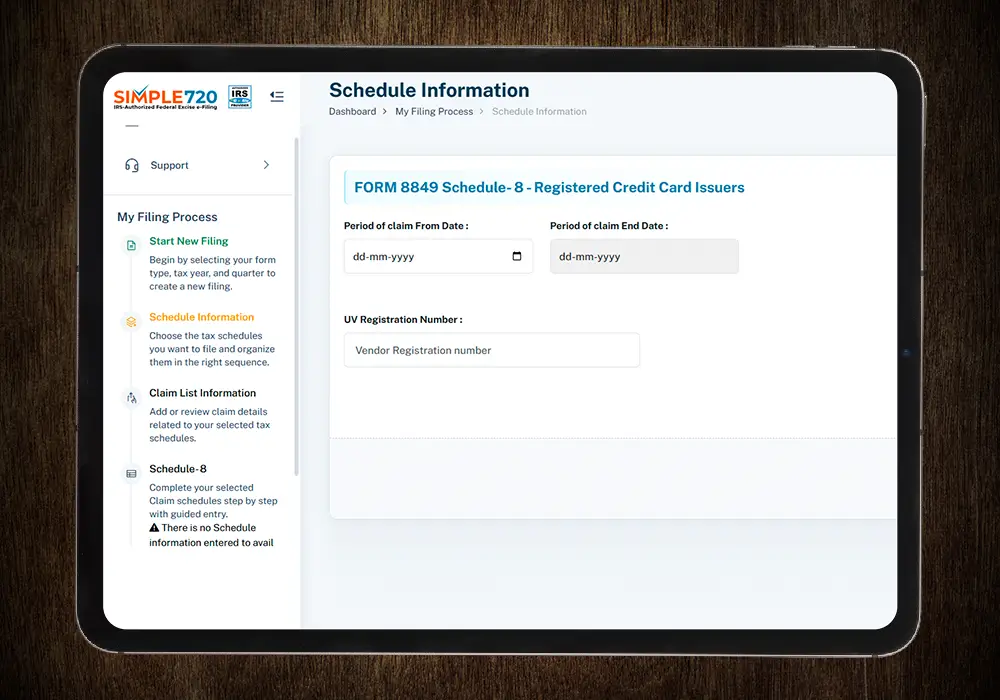

- Step 1 - If you are a new user, create a free account on Simple720. If you already have an account, simply log in using your credentials.

- Step 2 - Enter your business details or select the stored information from the drop-down menu. Choose "Form 8849 (Claim for Refund of Excise Taxes)" from the form type drop-down list.

- Step 3 - Select the appropriate schedule type from the dropdown. Choose "Form 8849 Schedule 8 -Registered Credit Card Issuers" then enter the year and month that your income tax year ends.

- Step 4 - Provide Period of claim (From date and To date). Enter the UV registration number. Select the respective category for your claim. Enter the quantity in gallons.

- Step 5 - After entering the above details, your claim amount will be automatically calculated and displayed on the dashboard. Once confirmed, submit your claim, and it will be successfully processed.

Benefits of Filing Form 8849 Schedule 8 Online

We had paid excise tax on aviation fuel that later qualified for a refund, but Schedule 8 requirements were not straightforward. Simple720 helped us identify the right filing approach and submit the claim with proper details. It removed confusion around eligibility and helped us file without delays.

Our challenge was understanding whether our aviation fuel use actually qualified under Schedule 8. Simple720 clarified the requirements and guided us through the filing steps. The process helped us submit an accurate claim and maintain proper records for future reference.

We were unsure how to handle an aviation fuel tax refund without risking errors. Filing manually felt risky. Using Simple720 gave us a structured way to file Schedule 8 correctly and reduced the back-and-forth we usually face with complex excise filings.