Still mailing Form 8849? Switch to online filing and receive your Form 8849

refunds in days, not years.

- File Form 8849 anywhere!

- No Software Download

- IRS Authorized

Claim Form 8849

- Executive Order 14247: Mandatory Shift to Electronic Filing

Executive Order 14247 requires the federal government to phase out paper-based filing by 2025, making electronic submission the standard. Filing Form 8849 online ensures your business stays compliant with this federal mandate while benefiting from faster and more secure processing. - IRS Emergency Notice Urges Businesses to E-File Form 8849

Based on IRS emergency announcements, manual paper submissions are experiencing major backlogs. Filing Form 8849 electronically helps businesses bypass these delays and receive quicker processing.

Form 8849 Claim Categories

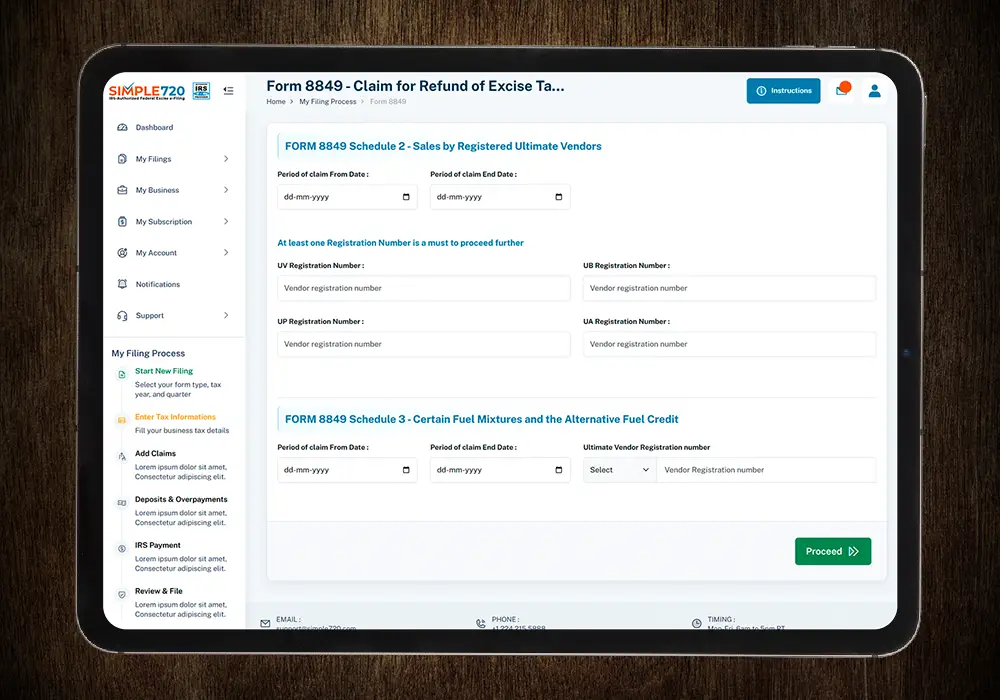

You Can File Online with Simple720

Used to claim a refund of federal excise tax for fuel that was used in ways the IRS considers non-taxable uses.

Used by registered ultimate vendors to claim refunds or credits for excise tax on certain fuel sales.

Used to claim credits or refunds related to fuel mixture credits and alternative fuel credits.

Used to request a refund of certain excise taxes paid under section 4081 of the Internal Revenue Code.

A “catch-all” schedule for excise tax refund claims not reportable on Schedules 1, 2, 3, 5, or 8, including refunds reported on Form 720.

Used by registered credit card issuers to claim refunds of excise tax paid on certain fuel sales to exempt entities.

Key Reasons to File Your Form 8849 Online

- 1) Quick Refunds with Online Filing

Traditional manual filing can result in long delays, with some refunds never being processed. By filing online, you can expect your refund to be processed and credited within weeks, ensuring a quicker resolution. - 2) Increased Accuracy with Automated Calculations

Our e-filing platform automatically performs the necessary calculations and verifies your information before submission, ensuring your claims are done on time without unwanted errors. This helps minimize the risk of rejections or follow-up actions.

Why File Your Form 8849 Online with Simple720

IRS-Authorized Portal

File your Form 8849 through a secure, IRS-authorized platform that meets all federal compliance standards and ensures accurate submission.

AICPA SOC Certified

Simple720 is AICPA SOC certified, demonstrating our commitment to data security and privacy through industry-standard encryption and controls.

Affordable Processing Fee

We offer transparent and affordable processing fees, helping you file Form 8849 efficiently without adding unnecessary costs to your business.

3 Simple Steps to Claim Your Form 8849

Refund with Simple720

STEP 1

Enter Business Details

Provide your business name, EIN, business type, address, signing authority details, email, and phone number.

STEP 2

Add Claim Information

Select the schedule and claim period, then enter the required details like TIN and quantity, which vary based on the selected category.

STEP 3

Submit and Get Your Refund

Pay the processing fee and submit your claim. Your refund will be issued once the IRS approves your Form 8849 submission.

Frequently Asked Questions

According to the IRS, businesses and individuals who paid federal excise taxes and qualify for a refund or credit can file Form 8849. This includes fuel sellers, transportation providers, and other eligible excise tax filers.

The IRS states that electronic Form 8849 submissions are processed faster than paper filings. Processing time may vary based on claim type and IRS workload, but e-filed claims typically receive quicker acknowledgment and handling.

Yes. The IRS allows eligible Form 8849 claims to be submitted electronically through IRS-authorized e-file providers. Electronic filing helps reduce processing time and provides faster IRS acknowledgment compared to paper submissions.

What Our Customers Say?

Fast Refund Processing

Simple720 made our Form 8849 claim process smooth and stress-free. We received IRS acknowledgment quickly and avoided long paper delays.

— Mark Reynolds, Texas

Easy and Reliable Filing

The platform was simple to use and guided us through every step of our Form 8849 submission. Everything was accurate and submitted without issues.

— Priya Patel, California

Professional Support Experience

Their support team helped us complete our Form 8849 claim correctly and on time. The entire process was fast and well-organized.

— David Thompson, Florida

Want to learn more?

Request a free demo today! Our experts are ready to assist you.

Book a Demo