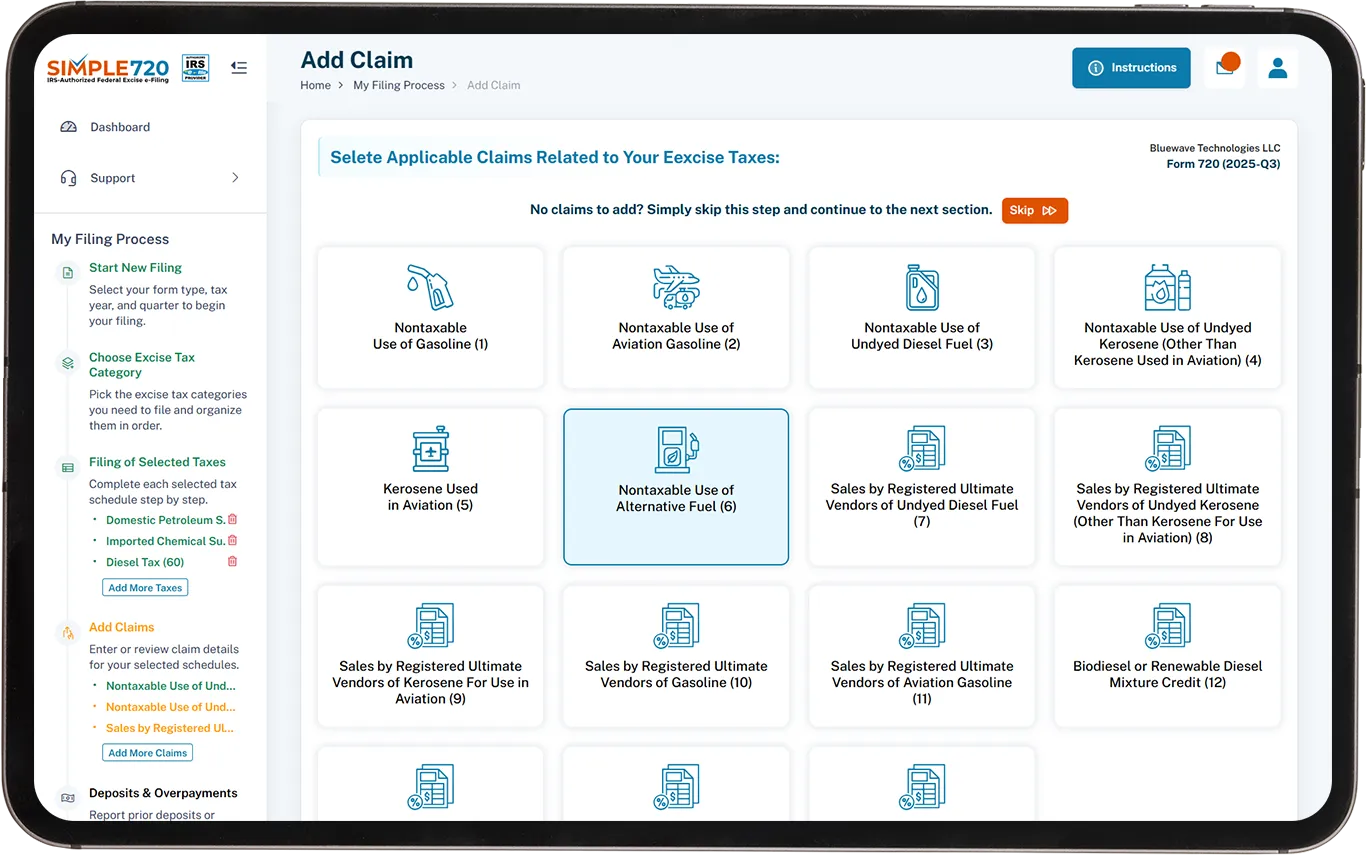

File Your Form 720 Schedule C

Claim for Nontaxable Use of

Alternative Fuel with Simple720!

- Seamless, user-friendly filing from start to finish

- Fast e-filing with built-in checks for accuracy

- Secure, anytime access to file and manage your claim online

What is Nontaxable Use of Alternative Fuel

under Schedule C Claim of Form 720?

Nontaxable Use of Alternative Fuel applies when alternative fuel has been used for an eligible purpose and the excise tax previously paid on that fuel may be claimed under Schedule C of IRS Form 720. This claim can be made only by the ultimate purchaser of the taxed alternative fuel, in accordance with the Schedule C requirements.

- Liquefied petroleum gas (LPG) used for a nontaxable purpose (Line 6a) is eligible for a claim at $0.183 per gallon.

- “P” Series fuels used for a nontaxable purpose (Line 6b) are eligible for a claim at $0.183 per gallon.

- Compressed natural gas (CNG) used for a nontaxable purpose (Line 6c) is eligible for a claim at $0.183 per gasoline gallon equivalent (GGE).

- Liquefied natural gas (LNG) used for a nontaxable purpose (Line 6d) is eligible for a claim at $0.243 per gallon.

- Liquefied hydrogen used for a nontaxable purpose (Line 6e) is eligible for a claim at $0.183 per gasoline gallon equivalent (GGE).

- Fischer-Tropsch process liquid fuel used for a nontaxable purpose (Line 6f) is eligible for a claim at $0.243 per gallon.

- Liquid fuel derived from coal (including peat) used for a nontaxable purpose (Line 6g) is eligible for a claim at $0.243 per gallon.

- Liquid fuel derived from biomass used for a nontaxable purpose (Line 6h) is eligible for a claim at $0.243 per gallon.

When You Are Eligible to Claim Nontaxable

Use of Alternative Fuel:

You are eligible to claim the nontaxable use of alternative fuel if it was used during the claim period for one of the allowable purposes specified under Schedule C of IRS Form 720.

The ultimate purchaser of the taxed alternative fuel is the only person eligible to make this claim. The alternative fuel must have been used during the claim period for one of the following types of use:

- Type of Use 1: On a farm for farming purposes

- Type of Use 2: Off-highway business use (for business use other than in a highway vehicle registered or required to be registered for highway use), other than use in mobile machinery

- Type of Use 4: In a boat engaged in commercial fishing

- Type of Use 5: In certain intercity and local buses

- Type of Use 6: In a qualified local bus

- Type of Use 7: In a bus transporting students and employees of schools (school buses)

- Type of Use 11: Exclusive use by a qualified blood collector organization

- Type of Use 13: Exclusive use by a nonprofit educational organization

- Type of Use 14: Exclusive use by a state, a political subdivision of a state, or the District of Columbia

- Type of Use 15: In an aircraft or a vehicle owned by an aircraft museum

Note - In all cases, the claimant must certify that the right to make the claim has not been waived.

How to Claim Your Nontaxable Use of Alternative Fuel

Why File Electronically for Nontaxable

Use of Alternative Fuel with Simple720?

Smooth and Straightforward Filing

Simple720 made filing my nontaxable use of alternative fuel claims incredibly easy. The guided steps helped me submit everything accurately without any confusion.

Quick, Secure, and Reliable

I was able to file my alternative fuel claim quickly and securely through Simple720. The process was efficient, and I received confirmation without any delays.

Helpful Support Every Step of the Way

I had questions about eligibility for alternative fuel credits, and the Simple720 support team provided clear guidance throughout the filing process. Everything was handled smoothly.

Want to learn more?

Request a free demo today! Our experts are ready to assist you.

Book a Demo