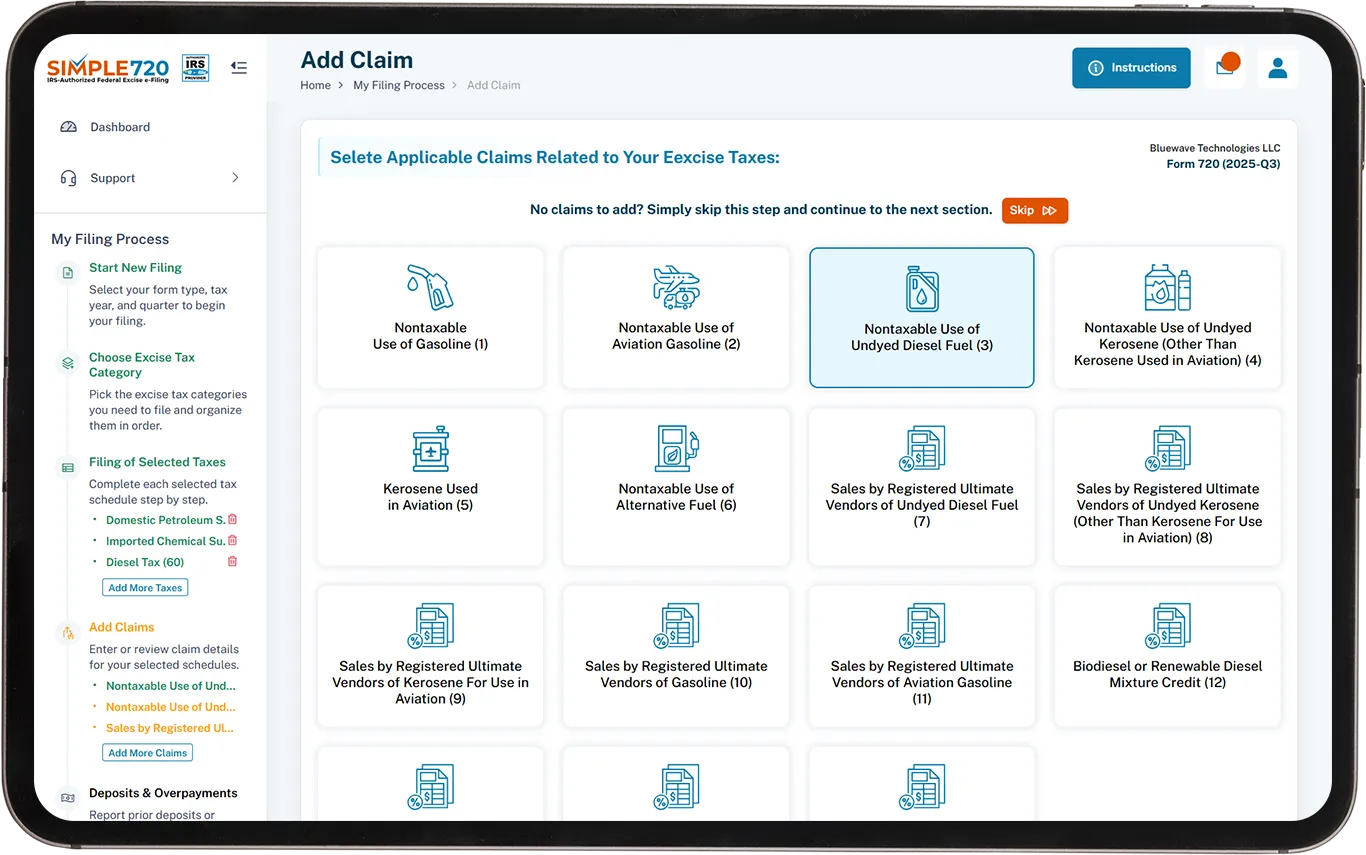

Maximize Your Form 720 Schedule C

Refund for Nontaxable Gasoline

Usage with Simple720!

- Effortless and efficient process

- Quick submission with guaranteed precision

- Available anytime, anywhere with secure online filing

What is Nontaxable Use of Undyed Diesel

Fuel under Schedule C Claim of Form 720?

Nontaxable use of undyed diesel fuel refers to situations where undyed diesel is used for specific, IRS-approved purposes that are exempt from excise tax. The fuel must meet certain criteria to qualify for the exemption, as outlined under IRS Form 720 Schedule C.

- Nontaxable use (Line 3a) is eligible for a claim at $0.243 per gallon.

- Use in trains (Line 3b) is eligible for a claim at $0.243 per gallon.

- Use in certain intercity and local buses (Line 3c) is eligible for a claim at $0.17 per gallon.

- Use on a farm for farming purposes (Line 3d) is eligible for a claim at $0.243 per gallon.

- Exported (Line 3e) is eligible for a claim at $0.244 per gallon.

When You Are Eligible to Claim Nontaxable

Use of Undyed Diesel Fuel

You are eligible to claim the nontaxable use of undyed diesel fuel if it was

used during the claim period for one of the following allowable purposes:

Type of Use for Line 3a:

For Line 3a, the diesel must have been used during the claim period for one of the following types of use:

Off-highway business use (business use other than in a highway vehicle registered or required to be registered for highway use), excluding personal use or use in a motorboat.

Diesel used in a qualified local bus

Diesel used in a bus transporting students and employees of schools (school buses).

Diesel used other than as a fuel in the propulsion engine of a train or diesel-powered highway vehicle (includes use as heating oil and in a motorboat).

Diesel used in a highway vehicle owned by the United States that isn’t used on a highway.

Note - Type of use 2 excludes personal use and use in a motorboat.

How to Claim Your Nontaxable Use of Undyed Diesel Fuel

Why File Electronically for Nontaxable Use of

Undyed Diesel Fuel with Simple720?

Seamless Claim Process for Aviation Gasoline

Simple720 made claiming my Nontaxable Use of Undyed Diesel Fuel credits straightforward and hassle-free. I was able to submit everything with just a few clicks. Highly recommended!

Easy Filing Experience

The platform was intuitive and easy to navigate. My Undyed Diesel Fuel claim was processed quickly, and I was able to track my refund status with ease. I'll be back next year!

Fast and Efficient Service

Filing my claim with Simple720 was incredibly fast. The instructions were clear, and I had no issues submitting my claim. Excellent service all around.

Want to learn more?

Request a free demo today! Our experts are ready to assist you.

Book a Demo