Easily File Your Sales by Registered Ultimate Vendors of Gasoline Claim with Simple720!

- Streamlined and effortless filing process from start to finish

- Fast and precise e-filing with built-in validation checks

- Secure, 24/7 access to manage and submit your claim online

What is Sales by Registered Ultimate Vendors of Gasoline(10) under Schedule C Claim of Form 720?

Registered ultimate vendors of gasoline(10) can file a claim on lines 10 of Form 720 if the buyer waives their right to claim by providing an unexpired certificate, as detailed in Model Certificate M in Pub. 510. A single claim can be made per gallon of gasoline. The gasoline must have been sold for use by nonprofit educational organizations or state/local governments, including essential use by Indian tribal governments.

- Line 10a: Eligible for a claim at $0.183 per gallon for gasoline used by a nonprofit educational organization.

- Line 10b: Eligible for a claim at $0.183 per gallon for gasoline used by state or local governments (including essential government use by an Indian tribal government).

-

Claim Requirements:

- The claim must be for gasoline sold or used during a period of at least one week, typically satisfied for quarterly claims filed on Form 720.

- The claim amount must total at least $200. This threshold can be met by combining amounts from lines 10 and 11.

- Claims must be filed by the end of the first quarter following the earliest quarter of the claimant's income tax year included in the claim. For example, a claim for January and February must be filed by April 30 on Form 720, while claims filed on Form 8849 are due by June 30.

- UV Registration Number: Ensure that your UV registration number is entered where indicated on the form.

- Required Documentation: Attach a separate sheet with the name and TIN of each nonprofit educational organization or government entity that purchased gasoline, along with the gallon quantity sold to each.

Why File Electronically for Sales by Registered

Ultimate Vendors of Gasoline(10) with Simple720?

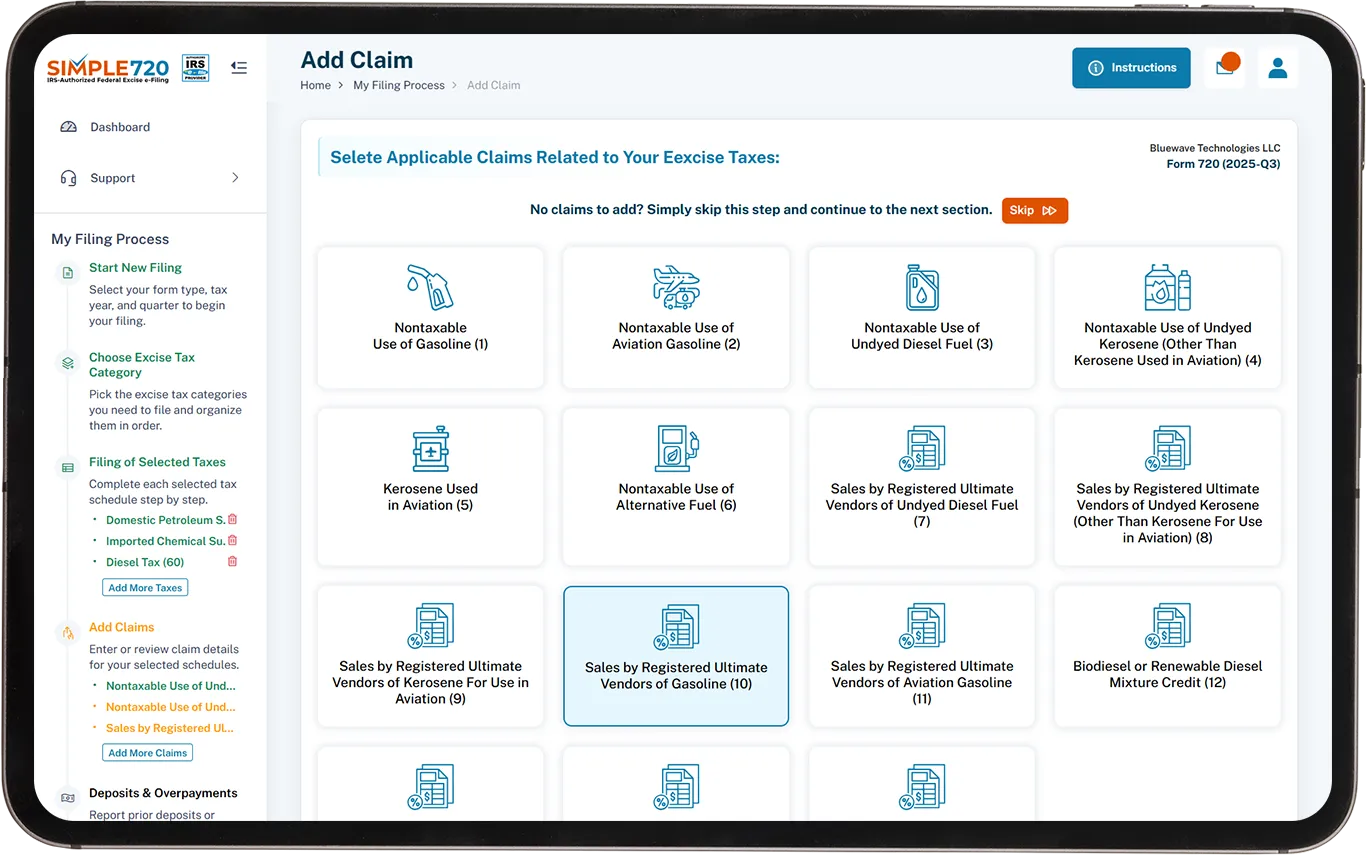

How to Claim Your Sales by Registered

Ultimate Vendors of Gasoline(10)

Seamless Filing Experience

Simple720 made filing my claim for sales of gasoline incredibly easy. The clear, step-by-step instructions ensured I could complete the process quickly and accurately without any confusion.

Effortless Navigation

Filing my gasoline claim was smooth with Simple720’s intuitive platform. The design made it easy to follow the process and ensure that all details were correctly entered.

Instant Acknowledgment

I was relieved to receive immediate confirmation after submitting my gasoline sales claim. The fast acknowledgment reassured me that my claim was successfully filed and in good hands.

Want to learn more?

Request a free demo today! Our experts are ready to assist you.

Book a Demo