Effortlessly Submit Your Sales Claim for Registered Ultimate Vendors of Undyed Kerosene with Simple720!

- Seamless and efficient filing from start to finish

- Fast and precise e-filing with built-in validation checks

- Secure, round-the-clock access to manage and submit your claim online

What is Sales by Registered Ultimate Vendors of Undyed Kerosene(Other Than Kerosene for Use in Aviation)(8) under Schedule C Claim of Form 720?

Sales by Registered Ultimate Vendors of Undyed Kerosene (Other Than Kerosene for Use in Aviation)(8) allow the registered ultimate vendor to file a claim for excise taxes previously paid on kerosene sold to eligible buyers. The claim applies to fuel sold for specific uses under Form 720, with the following conditions:

Claims are for kerosene sold to a state or local government, including essential government use by an Indian tribal government. The registered ultimate vendor must obtain the required certificate from the buyer, ensuring no false information is provided.

Claims are for kerosene sold from a blocked pump. The registered ultimate vendor must obtain a statement from the buyer, including the date of sale, buyer's details, and number of gallons sold.

Claims are for kerosene sold for use in certain intercity and local buses. The buyer must waive their right to make the claim by providing the registered ultimate vendor with an unexpired waiver.

Note: Only one claim can be filed for any gallon of kerosene.

- Line 8a (Sales to State or Local Governments and Indian Tribal Governments): Eligible for a claim at $0.243 per gallon for kerosene used by a state or local government, including essential government use by an Indian tribal government.

- Line 8b (Sales from Blocked Pumps): Eligible for a claim at $0.243 per gallon for kerosene sold from a blocked pump.

- Line 8c (Sales for Use in Certain Intercity and Local Buses): Eligible for a claim at $0.17 per gallon for kerosene used in certain intercity and local buses.

- Claim Period: The claim must be for kerosene sold during a period of at least one week. This requirement is generally met for quarterly claims filed on Form 720.

- Minimum Claim Amount: The total claim must be at least $100. Amounts from Lines 8 and 9 may be combined to meet this minimum.

- Filing Deadline: Claims must be filed by the last day of the first quarter following the earliest quarter of the claimant's income tax year that includes the claim. For example, a calendar year taxpayer’s claim for the first quarter is due by April 30 when using Form 720.

-

Eligible Sales:

Exclusive to Line 8a and 8b - For Line 8a, the claim must be for kerosene sold to a state or local government, including essential government use by an Indian tribal government.

For Line 8b, the claim must be for kerosene sold from a blocked pump.

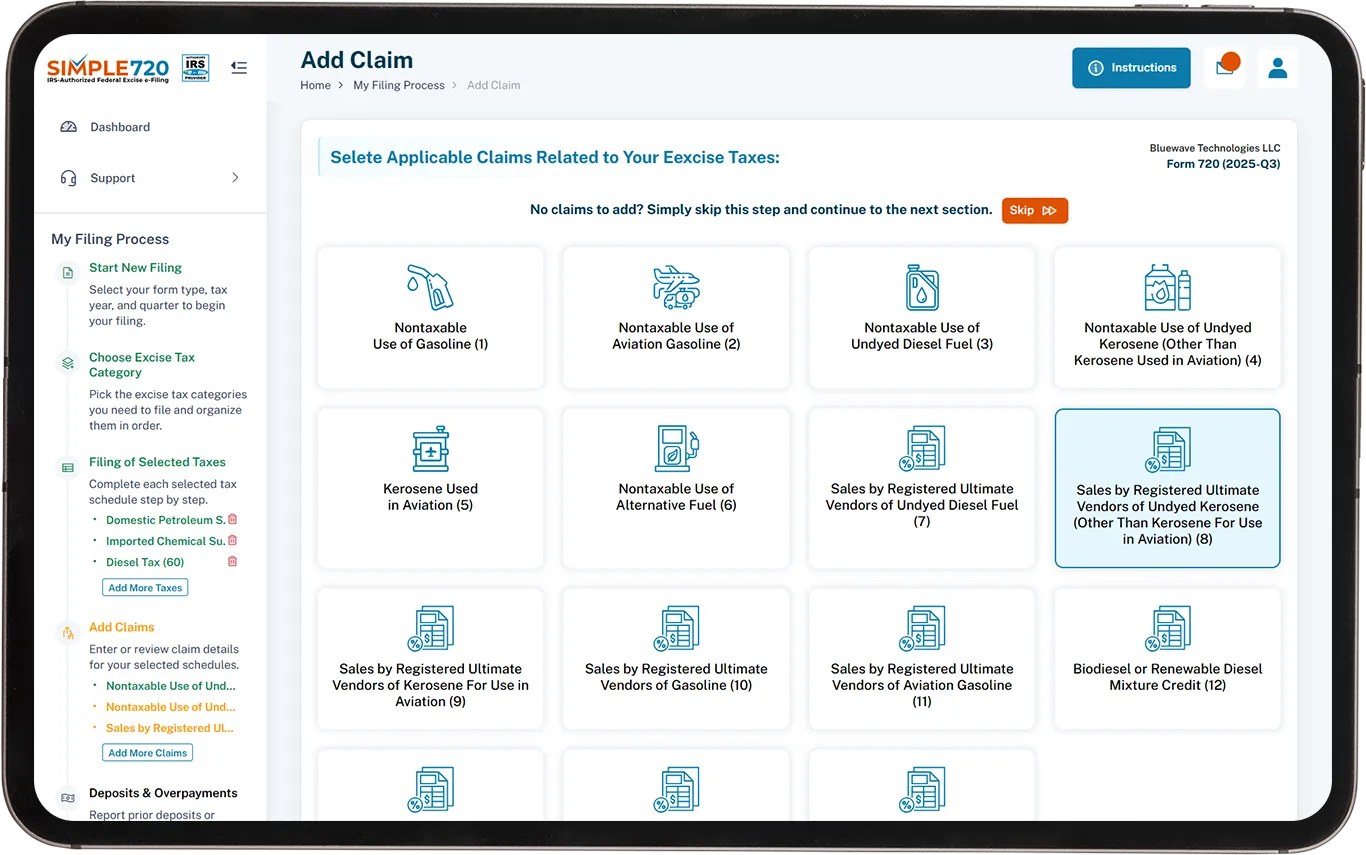

Why File Electronically for Sales by Registered

Ultimate Vendors of Undyed Kerosene(Other Than

Kerosene for Use in Aviation)(8) with Simple720?

How to Claim Your Sales by Registered Ultimate

Vendors of Undyed Kerosene(Other Than

Kerosene for Use in Aviation)(8)

Seamless & Secure Filing

Using Simple720 to file my claim was a breeze! The platform is secure, and I felt confident knowing my data was protected. Filing through an IRS-authorized portal made the entire process stress-free.

Jessica Lee, California

Simple720’s inbuilt error validation saved me time and ensured my claim was submitted correctly. It flagged any potential issues early on, making the entire filing process more efficient and reliable.

No-Cost Registration & Easy Start

Signing up for Simple720 was completely free, and the registration process was straightforward. I was able to file my claim without worrying about any upfront fees, and the platform made everything easy to understand.

Want to learn more?

Request a free demo today! Our experts are ready to assist you.

Book a Demo