Effortlessly Submit Your Sustainable

Aviation Fuel Credit Claim with Simple720!

- Easy and straightforward filing from start to finish

- Rapid and accurate e-filing with integrated validation tools

- Secure, anytime access to manage and submit your claim online

What is Sustainable Aviation Fuel Credit

under Schedule C Claim of Form 720?

The Sustainable Aviation Fuel (SAF) Credit allows the producer or seller of a qualified mixture (a blend of SAF and kerosene) to claim a credit. This credit is based on the gallons of SAF used in the mixture. To claim the SAF credit, the mixture must be used in an aircraft, and the credit must be claimed on Form 720, Schedule C. Only one claim can be made for each amount of SAF, and if a claim was made for the same SAF on other forms like Form 8864, 8849, or 4136, it cannot be claimed on Form 720.

In Schedule C, lines 12a, 12b, and 12c are reserved for future use, while line 12d is dedicated to claiming the Sustainable Aviation Fuel mixture credit.

- Minimum Claim Period: The claim must be for a qualified mixture sold or used during a period of at least one week, which is typically met for quarterly claims.

- Minimum Claim Amount: The claim amount must be at least $200. If the claim amount is below this, amounts from lines 12 and 13 may be combined to meet the minimum threshold.

- SAF Specifications: The SAF used in the mixture must meet specific standards, including ASTM D7566 Annex specifications or ASTM D1655 Annex A1. The SAF must also be certified to have at least a 50% reduction in lifecycle greenhouse gas emissions compared to petroleum-based jet fuel.

-

SAF Blending Component Certificate: For mixtures made with SAF synthetic blending components, you must attach a certificate detailing the gallons of SAF used. If already submitted with previous claims, provide a statement listing:

- Certificate number

- Total gallons of SAF

- Amount claimed on previous forms (e.g., Form 8864, Form 4136).

- Claim Information: Enter the number of gallons and the appropriate rate on line 12d. If multiple rates apply, provide a separate schedule detailing the rates and claimed gallons.

- Registration Number: If you're a registered blender or taxable fuel registrant, enter your registration number on line 12.

Why File Electronically for Sustainable

Aviation Fuel Credit with Simple720?

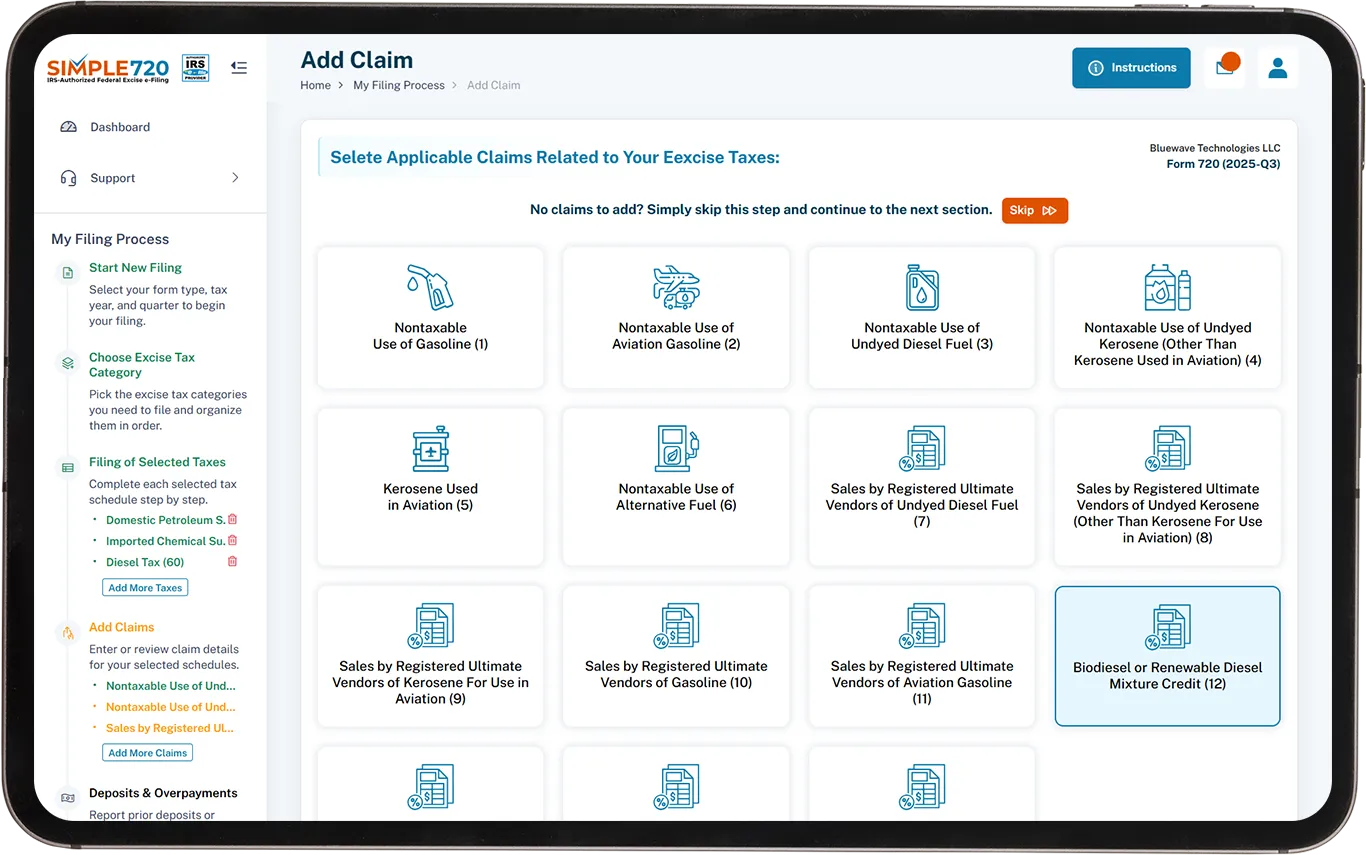

How to Claim Your Sustainable Aviation Fuel Credit

Secure & IRS-Compliant Filing Experience

I felt confident using Simple720 for my gasoline sales claim. The platform is IRS-authorized and the robust security measures ensured my data was fully protected.

Budget-Friendly Filing Solution

Simple720 provided an affordable solution for my gasoline sales claim. The pricing was reasonable and I got great value without compromising on quality or security.

Effortless Online Filing

Submitting my gasoline sales claim was so easy with Simple720. I didn’t have to download any software and everything was done directly through my browser, making the process hassle-free.

Want to learn more?

Request a free demo today! Our experts are ready to assist you.

Book a Demo