Effortlessly Submit Your Miscellaneous Claims under "Other Claims(14)" with Simple720!

- Smooth and hassle-free filing process from beginning to end

- Quick and precise e-filing with built-in validation features

- Safe, 24/7 access to manage and submit your claim online

What is Line 14 – Other Claims under

Schedule C of Form 720?

Line 14 of Schedule C of Form 720 is used for various miscellaneous claims. These claims are related to certain uses and resales of articles that are subject to manufacturer or retailer excise taxes under section 6416(b)(2). The claimant must certify that the article was sold at a tax-excluded price, that the tax was repaid to the ultimate vendor, or that written consent was obtained from the vendor to make the claim. The claimant must also provide the necessary supporting information for the claim.

- Line 14a – Section 4051(d) Tire Credit: This credit lets a taxpayer claim a credit for the excise tax previously paid on tires sold on or in connection with the first retail sale of a taxable vehicle (reported on IRS No. 33). Under Internal Revenue Code Section 4051(d), the credit equals the amount of tax imposed on such tires and is reported on Schedule C, line 14a of Form 720.

-

Line 14b and 14c – Exported Dyed Diesel, Kerosene, and Gasoline Blendstocks: For claims related to exported dyed diesel, dyed kerosene, or gasoline blendstocks taxed at $0.001 per gallon, the claimant must provide the following:

- The name and address of the seller.

- The dates of purchase.

- If exported, proof of export.

For exported gasoline blendstocks taxed at $.184 per gallon, the claim is made on line 1b.

-

Line 14d – Diesel-Water Emulsion: Claims for diesel-water emulsion are based on various use types. The claim rate is $0.197 for most uses, with special rates like $0.124 for certain use types (e.g., Type of Use 5). The claimant must certify that:

- The emulsion contains at least 14% water.

- Undyed diesel taxed at $.244 was used to produce the emulsion.

- The emulsion is used or sold in the blender's trade or business.

For exported emulsion, the rate is $0.198.

-

Line 14e – Registered Credit Card Issuers: Credit card issuers can file claims for gasoline, aviation gasoline, diesel, kerosene, or kerosene for aviation that were:

- Purchased by state or local governments (including Indian tribal governments) or nonprofit educational organizations.

- Be registered with the IRS.

- Not have collected the tax from the ultimate purchaser or have obtained their written consent.

- Certify that the tax has been repaid or arrangements have been made for reimbursement.

- Possess an unexpired certificate from the ultimate purchaser, certifying the fuel's use.

-

Tire Credits (Lines 14f–14h): A credit or refund (without interest) is allowed for tax-paid tires if they have been:

- Exported

- Sold to state/local governments or nonprofit educational organizations for exclusive use.

- Sold to qualified organizations like blood collector organizations.

- A detailed description of the claim.

- The amount and method of the claim calculation.

- The number of tires claimed for each CRN.

-

Other Claims and Tax Types (Lines 14i–14k): For claims under lines 14i–14k, the claimant must include:

- A detailed description of the claim.

- Any additional required information by the IRS.

- The claim amount and the method used to calculate it.

- Supporting documentation for the claim.

- Ozone-depleting chemicals (ODCs), luxury tax on passenger vehicles, gas guzzler automobiles, vaccines, and more. Claims for these taxes are identified by their CRN codes, such as CRN 398 for ODCs and CRN 340 for gas guzzler automobiles.

If any of these conditions aren't met, the credit card issuer cannot make the claim

Claims must be filed within 3 years from the return filing date or 2 years from when the tax was paid, whichever is later.

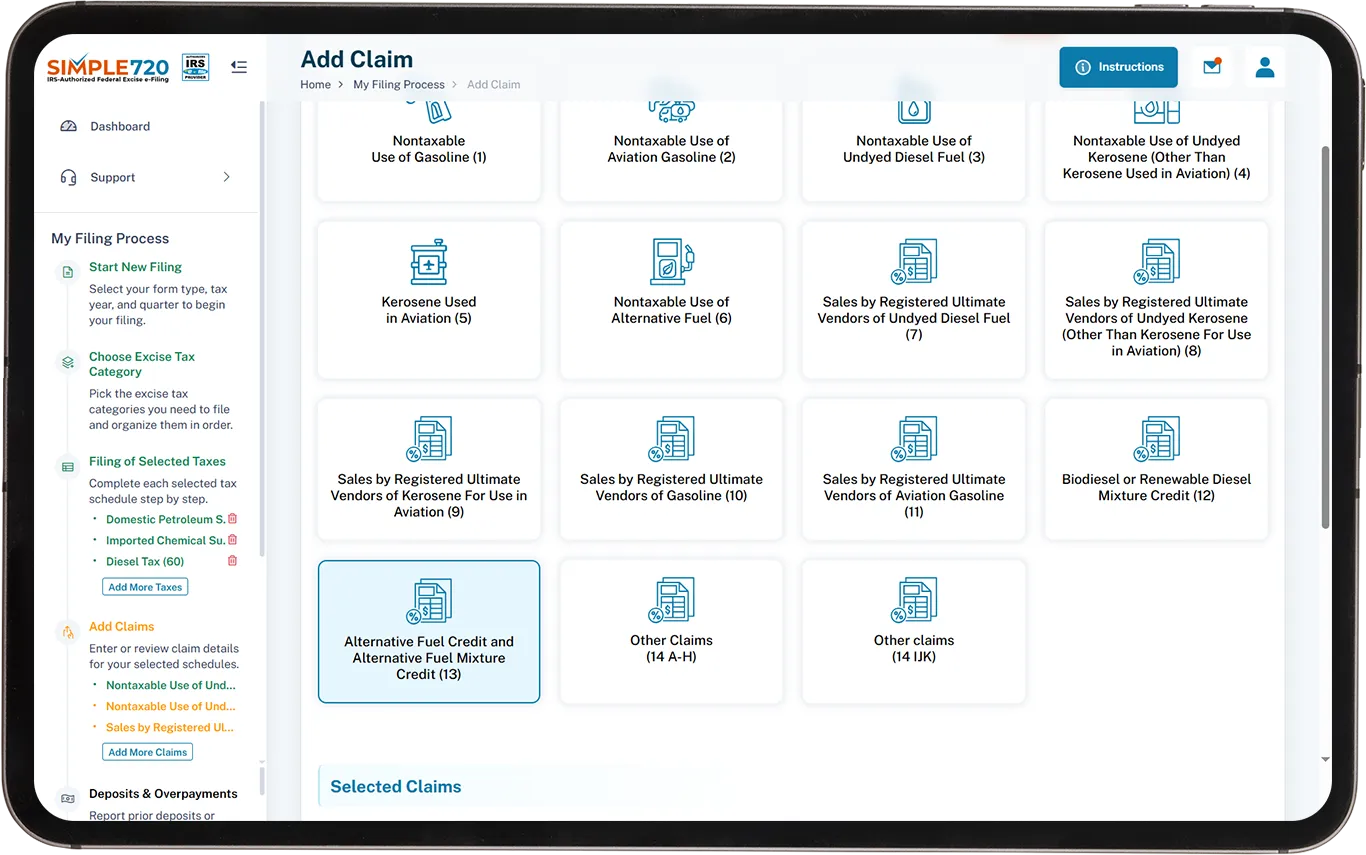

Why File Electronically for Other

Claims(14) with Simple720?

How to Claim Your Other Claims(14)

Trustworthy & Secure Platform

I felt completely confident submitting my claim through Simple720. The platform is secure, IRS-authorized, and the added security features gave me peace of mind.

Exceptional Customer Support

Simple720’s customer support was outstanding. Whenever I had a question, the team responded quickly and helped me resolve issues efficiently.

Quick and Efficient Processing

My claim was processed so quickly with Simple720! The system is fast and accurate, which saved me a lot of time. I was impressed by how seamless the whole experience was.

Want to learn more?

Request a free demo today! Our experts are ready to assist you.

Book a Demo